AMC Stock: How Much $10,000 Invested This Year Is Worth Now

Not many stocks will score a 1,931% gain in 11 months. And yet, that’s the power of AMC stock. A $10,000 investment in the struggling movie theater chain would be worth $203,103 now, following the roughly 9% rally Wednesday to 43.06. That’s an astounding get-rich-fast gain you’d be hard-pressed to find anywhere else. The increase in AMC Entertainment (AMC) makes even last year’s high-octane S&P 500 stocks look lame. This year, the same $10,000 plunked down on Apple (AAPL) would be worth just $11,347. And even $10,000 riding on Tesla (TSLA) is worth just: $16,636.

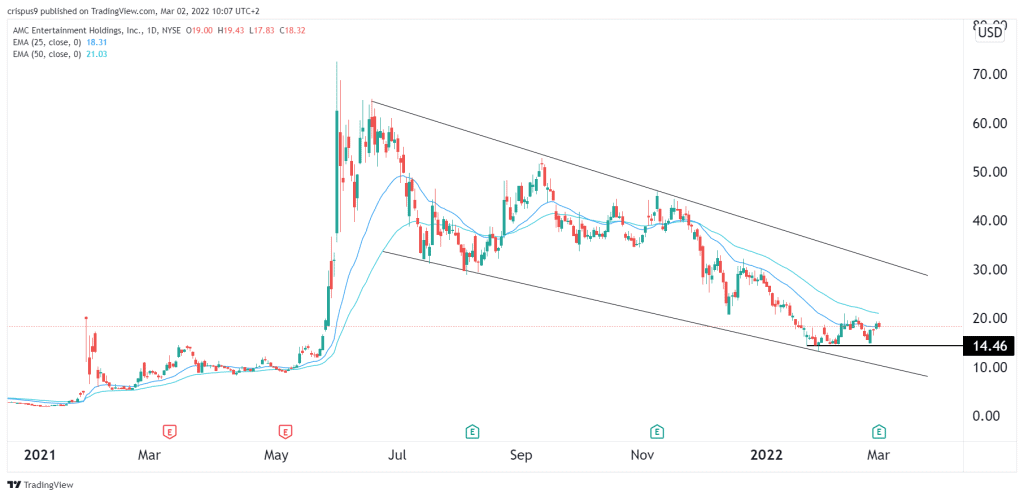

Why all the love for AMC stock? AMC stock is the new poster child for the rally in highly shorted stocks that took off in early 2021. It replaced GameStop (GME) as the leader in this so-called Reddit rally fanned by enthusiastic retail investors. AMC’s gain now surpasses GameStop’s robust 1,220% gain this year. Investors are encouraged as AMC took intelligent moves to stay afloat during the pandemic. That positions it to benefit from the economy’s reopening, or so investors hope.

“We recognize that it will take AMC years to repay its debt burden and longer until it can revisit its growth strategy,” says an analyst at Wedbush Securities, Michael Pachter. “We believe the company has sufficient liquidity to survive with low utilization through at least (the third quarter), now that most of its highest-earning theaters have reopened.”

What Is AMC Stock All About?

AMC Entertainment is a struggling movie theater chain. It’s a tricky spot to be in — especially since people increasingly watch movies at home using one of the many streaming services they subscribe to. Covid-19 also shut down many of the company’s roughly 1,000 theaters and 10,000 screens.

AMC is trying to restructure itself to reposition for a digital era. But it’s an uphill battle. AMC is seen losing an adjusted $1.3 billion, or $2.84 a share in 2021. That’s better than the revised $1.9 billion, or $16.15 a share; it lost in 2020. Still, losing money is a big blow to the whole story of AMC stock.

And on Aug. 10, the company showed some early signs of a turnaround. The company posted an adjusted loss of 71 cents a share in the June quarter. That topped views calling for a quarterly loss of 96 cents a share. It reports third-quarter results on Nov. 8.

Investors, though, are looking longer term. The company is paying down its $5.4 billion in long-term debt. And theaters are opening. Big Hollywood studios, too, are bringing compelling films for release in theaters again. Revenue is set to hit $5.2 billion by 2023. That’s just 5% shy of the $5.47 billion in revenue posted in 2019. Losses, though, are seen extending past 2023.

But the fact is, many movie fans are staying home to watch. A surprisingly large piece of Disney’s (DIS) new Black Widow Marvel movie revenue coming from streaming shows theaters may not be as vital as before the pandemic. With that said, Disney’s Shang-Chi opened to a solid first-weekend box office in the theater.